Some basic background of our CFD’s provided for the October 15, 2013 meeting:

Using the original land usage plan of the (WRSP) designating the number and types of homes to be built (total of 8,490), the City established the three (3) assessments we see on our tax bills as CFD’s—Community Facilities District –taxes designated as:

CFD No.1 - Public Facilities: Increases 2% per year--levied as long as needed to repay bond principal and interest and other costs of the District, but not past the 2050/51 tax year. This is the infrastructure, parks & open space improvements for this project. (We took exception to road improvements at a later meeting when we were told our fees can be applied to road projects anywhere in the city.)

CFD No.2 - Public Services: Increases 4% per year--levied in perpetuity as long as the services are provided. These are the services for improvement, management, and maintenance of open spaces, landscape, street-sweeping, pocket, and neighborhood park maintenance; any included planning, legal and city and county administration costs; and 'sinking funds' for future needs and CFD as determined by the Administrator. (That supposedly does not include Regional Parks like Mahany, Maidu and the new one to be built here).

CFD No.3 - Municipal Services: Increases each year by the lesser of 4% or the combined percentage increase, if any, in the City of Roseville General Fund Operating Budget for police and fire services; levied in perpetuity as long as the services are provided. These are police, fire, ambulance and paramedic services; recreation program services; library services, maintenance services for elementary and secondary school sites/structures, and operation/maintenance of museums and cultural facilities. Once again we have maintenance of parks, parkways, and open space. Flood/storm protection systems, and hazardous substance action. This assessment is higher in WRSP than in other areas.

CFD No.1 reads, “The special tax will be levied and collected for as long as needed to pay the principal and interest on bond debt and other costs incurred in order to construct the authorized facilities and to pay the annual costs. However, in no event shall the special tax be levied on any parcel in the CFD after Fiscal Year 2050-51.” The initial bond authorized for WRSP was $80 Million, but the CFD also includes:

- Debt service on the Special Tax bonds,

- Replenishment of the Bond Reserve Fund,

- Anticipated Tax Delinquencies,

- Administration of the CFD, and

- Reimbursement for eligible advanced-funded CFD facilities (including Pay-As-You-Go expenditures).

The administrator of the CFD (the person designated by the City to administer the Special Taxes) is supposed to calculate the yearly Rate and Method of Apportionment of Special Tax. There may be issues related to double assessments for city services through regular taxes that we pay through Mello Roos, i.e. recreation program service fees we pay which are the same as other areas that do not pay Mello Roos assessments.

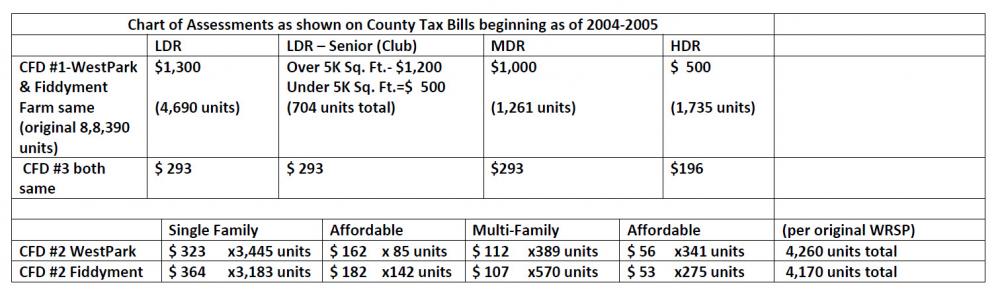

The actual amount of the Assessments for the West Roseville Specific Plan (WRSP) were based on lot size and definition (lot sizes and type of usage), generally referred by the following terms:

LDR = (low density residential) = 0.5 – 6.9 units per acre (mostly single family homes)

MDR = (medium density residential) = 7.0 – 12.9 units per acre (smaller townhome styles)

HDR = (high density residential) = 13.0 units per acre or more (apartments and zero-lot-line residences)

Using these terms, and the original build-out of 4,260 units for WestPark and 4,170 units for Fiddyment Farm, the assessments were broken down for the initial billing year of 2004-2005 as follows:

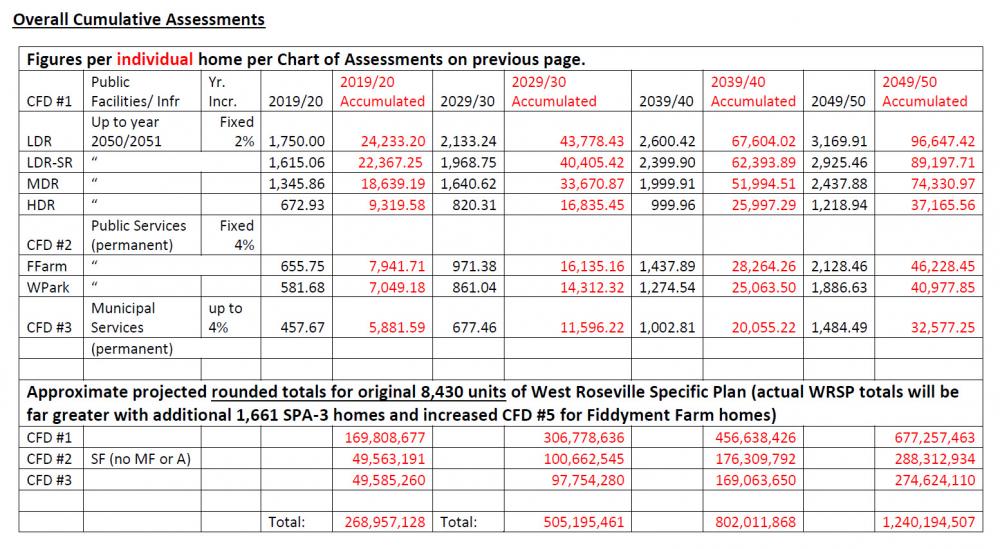

The following chart shows the projected total fees paid in 10-year increments, based on the initial year of 2004-2005 and projecting out to the full potential extent of CFD No.1. The chart is based on the original 8,430 homes of the WRSP, but may not be completely accurate because of specific plan amendments which have changed the current land usage from the originally projected build-out. So in some instances, we have used the higher assessments for the calculations. The first section gives figures (yearly amount and accumulated amount) per individual home. The second section indicates total figures for the original 8,430 homes (prior to SPA-3 addition and CFD #5 increases to new Fiddyment Farm Homes 2015/2016).

Recommended Comments

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.